Introduction and overview

Welcome! In this page you can find a quick overview of the Makecommerce ecosystem which will be explained more thoroughly in this page.

MakeCommerce's developer portal is divided into 5 sections.

| Section | Description |

| API Docs | API Docs is the starting point for using MakeCommerce ecosystem as a developer. This page has all the info gathered together or it is linking you to the right resource. |

| API Tester | API Tester can be used to try out our REST API endpoints. After reading API Docs this is the place to go try out some requests. We have made a small tutorial to get you started with the API tester: "How to use our API Tester?" |

| Payment Gateway | Create a transaction and get redirected to payment gateway. |

| Credit Card | Whole section for Credit Card flow. There you can find flow descriptions, test cards and some code snippets. |

| Notifications | Section about notifications. |

First steps

- Contact support@maksekeskus.ee to get your Merchant Portal (test environment) account opened

- API keys needed for development will be in the Merchant Portal (test environment)

Useful links

- Frontoffice live environment: https://merchant.maksekeskus.ee

- Frontoffice test environment: https://merchant.test.maksekeskus.ee

- Live API endpoint: https://api.maksekeskus.ee/v1

- Test API endpoint: https://api.test.maksekeskus.ee/v1

- API tester: https://developer.maksekeskus.ee/intro.php

- Our github: https://github.com/maksekeskus/

- FAQ: https://makecommerce.net/faq/

- Maksekeskus AS Service Status: https://status.maksekeskus.ee/

Integration modules supported

- Magento 2.0

- WooCommerce

- OpenCart

- Prestashop

- Magento 1.9

- CS-Cart

- Shoproller

- Voog

- MyCashFlow

- Shoperb

- Shopify

More info about integration modules: https://makecommerce.net/integration-modules/

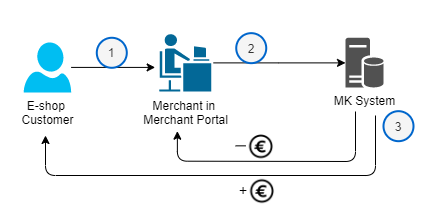

API integration flow

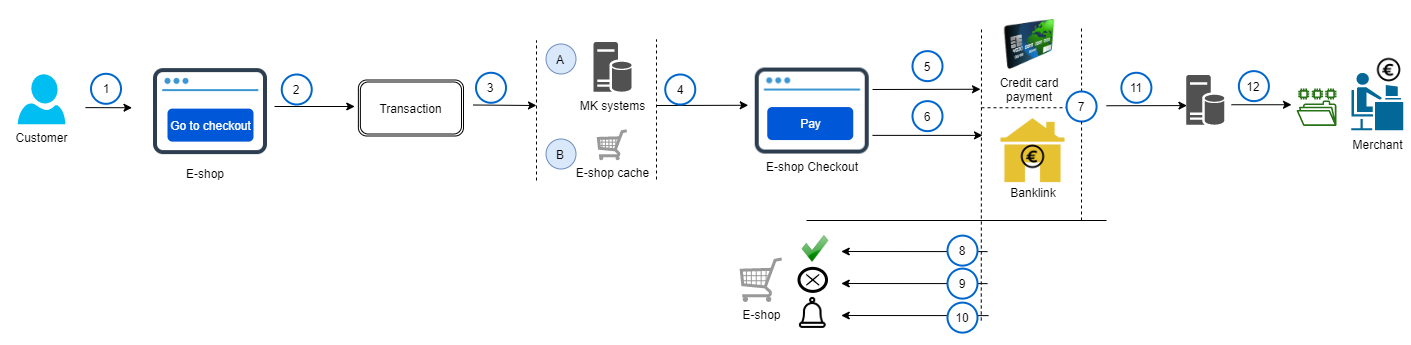

API integration. Payment method selection is inside the shop. Transaction first.

|

|

Receive payment methods after 'Create transaction'

|

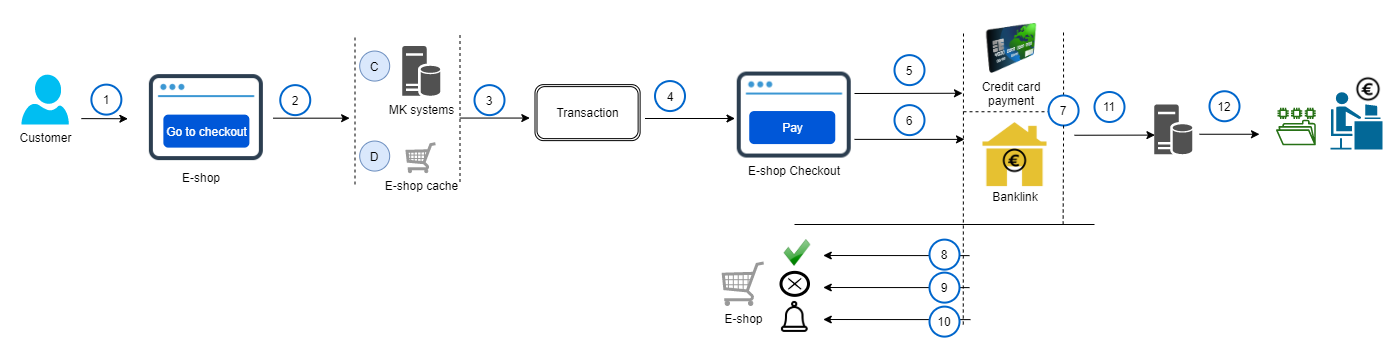

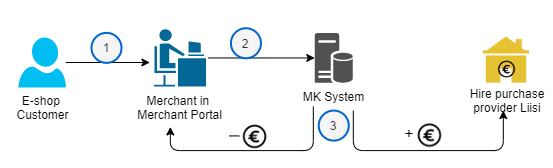

API integration flow, payment methods are requested first.

|

|

Receive payment methods before 'Create transaction'

|

Payment methods supported

- Bank links

- Credit cards

Overview of MakeCommerce services:

https://makecommerce.net/for-merchant/

Test environment

The Test Environment is a safe sandbox where you can explore and learn how our systems function without worrying about messing up your real account at MakeCommerce / Maksekeskus.

Find out more about Test environment:

https://makecommerce.net/for-developers/test-environment/

Transaction states

| Status | Description |

| CREATED | Transaction initiated by merchant |

| PENDING | Payment process has been initiated, customer is filling in data or payment is in progress in payment channel |

| CANCELLED | Customer has explicitly terminated the payment process – pressed ‘cancel’ button in bank’s payment dialog |

| EXPIRED | Customer has not completed the payment during 30 minutes in PENDING state |

| APPROVED | This state is relevant to some payment channels only – card payments, Citadele bank-link and DNB bank-links. On card payments this means that card data has been already verified, and transaction is waiting now for payment. Regular card payments are however automatically completed. |

| COMPLETED | Transaction has been successfully paid (green light for merchant to deliver goods/services). The funds will be transferred to merchant with next payout |

| PART_REFUNDED | The transaction amount has been partially refunded to the customer |

| REFUNDED | Transaction has been completely refunded |

Refund states

| Status | Description | Possible transitions |

| CREATED | Refund initiated by merchant | SENT |

| SENT | Refund order sent to bank or processor. Maksekeskus has sent out payment order to respective bank/card network. Respective amount is reserved in Merchant account at Maksekeskus. | SETTLED FAILED |

| SETTLED | Refund order settled by bank or processor. The money has most probably already reached to customer account. | |

| FAILED | Can happen only to refunds made to finnish bank-link payments. See more about complexity of Finnish bank-link refunds Or in case there was technical error while creating the refund at card payment processor |

API error codes

Client error response body

{

"code": 1001,

"message": "Invalid input",

"errors": [

{

"resource": "transaction",

"field": "currency",

"type": "invalid"

},

{

"resource": "customer",

"field": "ip",

"type": "missing"

}

]

}

HTTP Status Codes

API responds with the following HTTP status codes in case of errors:

| Error code | Description |

| 400 | Bad request, invalid body or parameters; business logic errors |

| 401 | Authentication failed or not sufficient (ie. when level 1 provided, but level 2 required) |

| 404 | Resource does not exist or is not available for this shop (belongs to another shop) |

| 409 | Resource conflict |

| 415 | Request content type is not application/json. |

| 500 | Server Error: all server internal errors |

Error Response Body

Client Errors:

In case of client errors, API responds with a code and message parameter. An optional errors collection may be returned with more information about the error occurred.

Server Errors:

Server errors return no response body.

Business logic errors

All business logic errors are returned with a 400 HTTP Status.

| Code | Message |

| 1001 | Invalid request |

| 1002 | Resource not found |

| 101x | Errors related to shop or merchant |

| 1011 | Shop not active |

| 1012 | Card payments not enabled for this shop |

| 1013 | OCP or Recurring disabled for shop |

| 102x | Errors related to transactions |

| 1021 | Transaction in wrong status |

| 103x | Errors related to payments |

| 1031 | Payment in wrong status |

| 1032 | Cannot make payment (transaction status violation) |

| 1033 | Card expired |

| 1034 | Not sufficient funds |

| 1035 | Payment declined |

| 1036 | Authorization failed |

| 104x | Errors related to refunds |

| 1041 | Transaction in wrong status, cannot be refunded |

| 1042 | Refund amount greater than available to refund |

| 105x | Errors related to customers |

| 106x | Errors related to tokens |

| 1061 | Invalid transaction |

| 1062 | Transaction conflict |

| 1063 | Failed to create Payment Token |

| 1064 | Token expired |

| 1065 | Token in wrong status |

| 2003 | Unable to deposit payment |

| 2005 | Unable to refund payment |

Test credit cards

- 4505131234000011 - valid until: 06/28 | CVC: 123

- 5191631234000016 - valid until: 06/28 | CVC: 123

To test 0-amount Authorization & "Save Card functionality", please use the cards that have defined expiration date and CVC

To simulate decline you should use same test cards with amount 99.99 EUR. All card payments with such amount will fail.

Getting Started

Basic Flow

- The buyer has reached to the check-out page on e-shop site

- The shop presents the selection of payment methods available

- The buyer makes a choice and proceeds to payment

- The shop registers a new Transaction in MK-API and directs user to the selected payment channel – either redirects to bank-link or launches the Credit Card Dialog

- Shop server now creates the transaction in MK API and recieves back an array of urls pointing to payment channels

- Depending on method the user selected, the e-shop server:

- Case banklink: redirects user to the banklink url supplied by the transaction creation response

- Case credit card: launches MK Credit Card Dialog by invoking checkout.js

- Payment links should not be placed inside an iframe, otherwise payments will not work.

- The user performs the payment in the channel

- Returning from:

- Bank link: user is redirected to

return_urlof the shop withpayment_returnmessage - Credit card dialog: user is redirected back with

token_returnmessage (POST toreturn_url)

- Bank link: user is redirected to

- Payment links should not be placed inside an iframe, otherwise payments will not work.

- The shop will verify the message and state of transaction within and display successful payment confirmation page (or goes back to payment method selection step)

- MK servers will send additional async message about the transaction status change to the shop server’ notification_url (see notifications). Your server must firstly return a successful status code (2xx) and only then execute any other logic on your system, otherwise timeout could be caused if 2xx is not returned in 30 seconds.

Create account

Request us to create you an account in our Test Environment so you could explore and test your integration in full.

Send your request to: support@maksekeskus.ee

We will create you a shop in our Test environment.

This is how you get you API keys for the integration.

SDK

We do have a small library for PHP available in github.

Java SDK

We also have a library for Java available in github.

Return URLS

As you see in the basic flow description in the basic basic flow section, your shop is expected to accept few messages about payments from MK systems. The messages may arrive in-band (from user browser) or directly from MK server to your e-shop server (M2M).

There are 2 messages:

payment_returnmessagetoken_returnmessage - used for card payments

The shop should implement following entry-points where the user (and the messages) can be sent:

return_url- main interface,cancel_url- optional, used when user deliberately cancels the payment in the channelnotification_url- this is where M2M messages are sent (processing time should be below 10s (http request timeout))

The entry-points can be declared in your shop configuration, you can change them in Merchant Portal under API settings. You can get there by going to Test Merchant Portal

Alternatively, you can dynamically specify them for each transaction when you create the transaction (transaction_urls). For example using API tester you can set these urls here API tester - Create transaction

If you have problems with this please take a look at "How to use our API tester?" section.

How to use our API tester?

Using our API tester for the first time can be confusing.

Setting up your API tester context:

- Firstly choose a context Setup your context

- For example select in the Predefined setup "mk-test" or setup your own API keys from the Shop Configuration. Make sure you use test environment

- After setting up your context with either predefined setup or your shop setup click on the Save context button which is located in the bottom of the page.

Making your first API tester request

We will be creating a transaction as an example.

- Go to https://developer.maksekeskus.ee/transaction.php

- By default all the required fields are filled in so the "Create transaction" button will work and it will create a transaction using the context you set in previous steps. (Edit these fields to play around and see how it works)

- If response code "201" is shown on the page then the request was successful

- In the response body you can see all the payment method links and these are duplicated also in the bottom of the page.

- Clicking on "redirect" link in the bottom of the page will send you to the payment page of just created transaction.

Making requests with REST API

Environments & Endpoints

- Live environment

- Merchant Portal - https://merchant.maksekeskus.ee/

- API Endpoint - https://api.maksekeskus.ee/v1/

- Test environment

- Merchant Portal - https://merchant.test.maksekeskus.ee/

- API Endpoint - https://api.test.maksekeskus.ee/v1/

The Test Environment is a safe sandbox where you can explore and learn how our systems function without worrying about messing up your real account at MakeCommerce / Maksekeskus.

These two environments are totally isolated - the identifiers and API keys are different in the Test and Live environments – so please be careful and do not mix them up

Authentication

curl -u 1ca58c6f-89c2-442f-950a-cd5fa3484397:d4a581cceff06c03a49915643661ee75 https://api.maksekeskus.ee/transactions

API requests are made via HTTPS. Each request must be authenticated with HTTP Basic Authentication using Shop’s ID (as username) and an API authentication key (as password)

Two types of authentication keys exist:

- Public key can be used for /v1/tokens - credit card token creation & lookup, /v1/methods - getting payment methods and /v1/shipments/destinations - getting shipment destinations

- Secret Key (currently also known as API key) is used for requests like creating payments, charging cards, etc.

The API tokens can be found under the API settings section in the Merchant Interface. Remember that anyone who has the authentication token has access to see and change everything available via the API. If an API key has been discovered by another party, it can be changed using Reset the Publishable/Secret Key option under the API settings section in the Merchant Interface.

Validating the response

Java code example for validating the response

private static String sha512(String input, String secret) {

MessageDigest md5;

try {

md5 = MessageDigest.getInstance(SHA_512);

} catch (NoSuchAlgorithmException e) {

throw new RuntimeException(e);

}

md5.update(input.getBytes(StandardCharsets.UTF_8));

md5.update(secret.getBytes(StandardCharsets.UTF_8));

byte[] digest = md5.digest();

StringBuilder sb = new StringBuilder();

for (int i = 0; i < digest.length; ++i) {

sb.append(Integer.toHexString((digest[i] & 0xFF) | 0x100), 1, 3);

}

return sb.toString().toUpperCase();

}

}

All message-specific content is sent as an JSON object in request parameter json and the message authentication code (MAC) is sent in request parameter mac.

The MAC is composed as follows:

UPPERCASE(HEX(SHA-512(string(JSON) + string(Secret Key))))

So to validate the message authenticy compose the MAC based on the received ‘json’ and the SecretKey of your Shop, and compare the computed MAC with the one you recieved from request.

In the right side of the screen Java example of validating the response can be found.

Request limits

- We have set IP based limits for max amount of requests:

- 1s: 15

- 10s: 100

- 1min: 200

- 5min: 1000

Shop

Shop object

A shop represents an entity that is collecting online payments.

Get configuration

$myEnvironment=array(

'platform'=>'magento 2.1',

'module'=>'codejunkies 1.0.1');

$request = array('environment' => json_encode($myEnvironment) );

$shop = $MK->getShopConfig($request);

HTTP REQUEST

GET /v1/shop/configuration

Retrieves configuration of the 'Shop’ as an json array that can be handy to cache on your server side. (You could refresh this i.e. each hour or daily).

Most importantly the returned data contains:

- Payment methods available for the shop - use this to render selection of payment methods in checkout dialog. The list may change over when payment channels are added or removed by MK. Channels are ordered by country, so you can use the order for UI. We intend to make logos for the channels to be available on our server.

As input we ask you to provide description of the integration environment - info about the e-commerce platform and integration module you are developing. We need this information for better problem resolution capability and for estimating imapct of changes in our API.

HTTP RESPONSE

JSON: Shop Object

Get payment methods

HTTP REQUEST

GET /v1/methods?transaction=&amount=¤cy=&country=

GET /v1/methods has four possible GET parameters

| Parameter | Required | Description |

| transaction | no | Returns payment methods available for the specific transaction |

| amount | no | Returns payment methods available for the specific amount |

| currency | no | Returns payment methods available for the specific currency |

| country | no | Returns payment methods available for the specific country |

Retrieves payment methods that are available.

The returned data contains all the available payment methods, which are grouped into four subarrays:

- banklinks

- cards

- paylater

- other

HTTP RESPONSE

Array of available payment methods

Obtaining the shop specific payment methods via shop configuration

It is also possible to retrieve shop specific methods with the shop configuration request. The response has all the information about the specific shops' configuration but also has all the available payment methods included

Read more about the shop configuration

Obtaining the transaction specific payment methods when creating the transaction itself

Lastly, all the possible payment methods for a specific transaction are included in the response, whenever the transaction is created.

Read more about creating transactions

Get account statement

$request = array( 'since' => date("Y-m-d", strtotime("-1 Months")) );

$statement = $MK->getAccountStatement($request);

Get account statement response body

[

{

"created": "2019-04-12T09:09:09+0000",

"amount": 12.95,

"type": "INCOME",

"transaction": "468526",

"channel": "Visa/Mastercard",

"balance_before": 212.82,

"balance_after": 225.77,

"merchant_reference": "123abc",

"payout_id": "17041",

"original_amount": 0.0,

"exchange_rate": 0.0

},

{

"created": "2019-04-12T09:09:09+0000",

"amount": -0.3,

"type": "TRX_FEE_FIX",

"transaction": "468526",

"channel": "Visa/Mastercard",

"balance_before": 225.77,

"balance_after": 225.47,

"merchant_reference": "123abc",

"payout_id": "17041",

"original_amount": 0.0,

"exchange_rate": 0.0

},

{

"created": "2019-04-12T09:09:09+0000",

"amount": -0.06,

"type": "VAT",

"transaction": "468526",

"channel": "Visa/Mastercard",

"balance_before": 225.47,

"balance_after": 225.41,

"merchant_reference": "123abc",

"payout_id": "17041",

"original_amount": 0.0,

"exchange_rate": 0.0

}

]

HTTP REQUEST

GET /v1/shop/accountstatements

GET /v1/shop/accountstatements/xml

GET /v1/shop/accountstatements/camt053

Either since or payout_id is required other fields are voluntary.

For XML and camt053 format endpoint until parameter is also required!

| Field | Description |

| since | From which date you wish to query account statements. (Example since=2019-04-10%2B0300) |

| payout_id | Statements for with this payout_id |

| page | Which page to show. This is useful for frontend together with per_page parameter |

| per_page | How many statements in one page. This is useful for frontend together with page parameter |

| until | Until which date you wish to query account statements. |

Returns all movements on your account, including service fees, payouts etc.

Parameters 'since’ and 'until’ can be expressed as date or timestamp. If no timezone is indicated then UTC is applied

See response example in right panel

You may also request the statement as an .xml file

HTTP REQUEST EXAMPLES

GET /v1/shop/accountstatements?payout_id=17041&since=2019-04-10%2B0300

GET /v1/shop/accountstatements/xml?since=2019-04-10%2B0300&until=2019-04-10%2B0300

GET /v1/shop/accountstatements/camt053?since=2019-04-10%2B0300&until=2019-04-10%2B0300

Get fees

HTTP REQUEST

GET /v1/shop/fees

Returns accounting records that are not realted to transactions (monthly service fees).

$request = array( 'since' => date("Y-m-d", strtotime("-1 Months")) );

$statement = $MK->getShopFees($request);

Get fees response body

[

{

"object":"accounting",

"amount":-10.0,

"vat":-2.0,

"id":"bf37a5d4-4b7f-4f44-900c-b288cd1562da",

"created_at":"2019-04-30T01:00:37+0000"

},

{

"object":"accounting",

"amount":-10.0,

"vat":-2.0,

"id":"11c14967-6cbf-45bc-a618-bcc44e2b4d37",

"created_at":"2019-04-30T20:30:07+0000"

},

{

"object":"accounting",

"amount":-5.0,

"vat":-1.0,

"id":"b460f282-0346-45be-b8e8-8a455cde17d6",

"created_at":"2019-04-30T20:30:07+0000"

}

]

| Field | Required | Description |

| since | Yes (when using api tester, no with Postman) | From which date from you would like to query fees. |

| until | No | Until which date you would like to query fees to. |

| page | No | Which page to show. This is useful for frontend together with per_page parameter |

| per_page | No | How many statements in one page. This is useful for frontend together with page parameter |

HTTP REQUEST EXAMPLE

GET /v1/shop/fees?since=2019-04-10%2B0300

Transaction

Create transaction

$reqbody = array(

'transaction' => array(

'amount' => '75.95',

'currency' => 'EUR',

'reference' => '123abc'

),

'customer' => array(

'ip' => '10.128.96.76',

'country' => 'ee',

'locale' => 'en'

),

'app_info' => array(

'module' => 'WooCommerce',

'module_version' => '3.4.2',

'platform' => 'Wordpress',

'platform_version' => '6.1'

)

);

$transaction = $MK->createTransaction($_POST);

Example JSON body minimal fields

{

"transaction":{

"amount":"75.95",

"currency":"EUR",

"reference":"123abc"

},

"customer":{

"ip":"10.128.96.76",

"country":"ee",

"locale":"en"

},

"app_info":{

"platform":"Wordpress"

}

}

Example JSON all fields

{

"transaction":{

"amount":"75.95",

"currency":"EUR",

"reference":"123abc",

"merchant_data":"Internal Order ID: 321",

"recurring_required":"false",

"transaction_url": {

"return_url": {

"url": "https://example.com/return_url",

"method": "POST"

},

"cancel_url": {

"url": "https://example.com/cancel_url",

"method": "POST"

},

"notification_url": {

"url": "https://example.com/notification_url",

"method": "POST"

}

}

},

"customer":{

"email":"mk.test@maksekeskus.ee",

"ip":"10.128.96.76",

"country":"ee",

"locale":"en"

},

"app_info":{

"module":"WooCommerce",

"module_version":"3.2.0",

"platform":"Wordpress",

"platform_version":"5.1"

}

}

HTTP REQUEST

POST /v1/transactions

To create a new transaction simply provide a JSON object containing the required attributes for the new transaction. When creating a new transaction, an embedded payment_methods list is returned, containing the available payment methods for making a payment for this transaction. Transaction amount and currency are required. Transaction reference max-length is 20 characters.Customer ip is required. Customer country must be passed as an alpha-2 code according to ISO 3166-1. Customer locale must be passed as an alpha-2 code according to ISO 639-1. Transaction_url - optionalEach shop has its set of urls manageable in Mercant Portal under the API settings. You can optionally over-ride these urls when creating the transaction. If specified then full set must be provided (return_ur, cancel_url, notification_url)

Customer object

| Field | Required | Description |

| country | No(Default will be chosen if not provided) | ISO 3166 country code List of ISO 3166 country codes |

| email; | No | Customer email. |

| locale | No(Default will be chosen if not provided) | ISO 639-1 locale code List of ISO 639-1 locale codes |

| ip | Yes | Customer IP address. |

Transaction object

| Field | Required | Description |

| amount | Yes | Transaction amount |

| currency | Yes | Transaction currency |

| id | No | Transaction ID |

| merchant_data | No | Use this to pass additional data. It will be available in API and displayed in merchant portal but not in callback messages. |

| recurring_required | No | true/false. If true payment can be done only with recurring card payment. |

| reference | No | Set a reference for the transaction. |

| cancel_url, notification_url, return_url | No | Each shop has its set of urls manageable in Mercant Portal under the API settings You can optionally over-ride these urls when creating the transaction It might be handy at some e-commerce platforms where otherwise it is difficult to determine previous context (i.e. user language) Or situation when multiple developers are working on integration of one shop on their local work stations. Be careful to provide correct urls, with protocol (i.e. https://myshop.com/returnhandler/). We reccommend to use POST method. If already, then you have to specify full set - you can not pass just one of the 3 urls (though they can be equal) |

app_info object

Not required but recommended: used for identification of software for debugging and statistics

| Field | Required | Description |

| module | No | Module name, that the request is sent from. (Up to 64 characters) |

| module_version | No | Module version in use. (Up to 64 characters) |

| platform | Yes |

Platform name, that the request is sent from. (Up to 64 characters) Required only if app_info is used in the request |

| platform_version | No | Platform version in use. (Up to 64 characters) |

Get transaction

$transaction = $MK->getTransaction($transaction_id);

HTTP REQUEST

GET /v1/transactions/{id}

| Field | Description |

| id | Transaction ID you get from here: Create transaction |

HTTP RESPONSE

JSON: Transaction Object

Get transaction statement

$transaction = $MK->getTransactionStatement($transaction_id);

HTTP REQUEST

GET /v1/transactions/{id}/statement

| Field | Description |

| id | Transaction ID you get from here: Create transaction |

HTTP RESPONSE

JSON: Transaction Object

Get transaction list

$request = array( 'since' => date("Y-m-d", strtotime("-1 Months")) );

$transaction = $MK->getTransactions($request);

HTTP REQUEST

GET /v1/transactions

| Field | Description |

| since | From which date you wish to query transactions. (Example since=2019-04-10%2B0300) |

| until | Until which date you wish to query account transactions. |

| completed_since | Transactions in completed status from the date (Example completed_since=2019-04-10%2B0300) |

| completed_until | Transactions in completed status to the date (Example completed_until=2019-04-10%2B0300) |

| refunded_since | Transactions in refunded status from the date (Example refunded_since=2019-04-10%2B0300) |

| refunded_until | Transactions in refunded status to the date (Example refunded_until=2019-04-10%2B0300) |

| status | One or more transaction status. (Example status=approved%2Ccompleted) |

| page | Which page to show. This is useful for frontend together with per_page parameter |

| per_page | How many statements in one page. This is useful for frontend together with page parameter |

HTTP RESPONSE

JSON: array of Transaction Objects

HTTP REQUEST EXAMPLE

GET /v1/transactions?since=2019-04-10%2B0300&status=approved%2Ccompleted

Add merchant data to transaction

Merchant data can be overwritten. New request overwrites and replaces the old merchant data.

$transaction_id = '0368156c-...-282f7eada86a';

$request_body = array('merchant_data' => 'my new metadata');

$transaction = $MK->addTransactionMeta($transaction_id, $request_body);

HTTP REQUEST

POST /v1/transactions/{transaction_id}/addMeta

HTTP RESPONSE

JSON: Transaction Object

HTTP REQUEST EXAMPLE

POST /v1/transactions/f8c02f00-7e1e-409e-9fd5-b0986ad7f602/addMeta

Create payment

$request = array(

'token' => '6385f130-8e5a-409a-a88b-ac0eefe1467e'

);

$payment = $MK->createPayment($transaction_id, $request);

Example JSON request body

{

"token": "2d1abacb-de54-4b2f-94c7-35230d0c6289"

}

HTTP REQUEST

POST /transactions/{id}/payments

You create payment in the flow of Recurring Credit Card Payment.

In context of bank-link payments flow the 'payment’ creation operation is irrelevant.

Refund

Integration overview

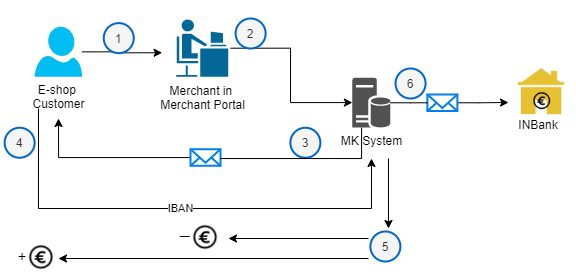

Partial refund with Inbank Slice

Partial refunding flow with Inbank Slice

|

If Customer never replies to MK IBAN request message, then the process ends after 3 e-mail requests are sent out to customer. |

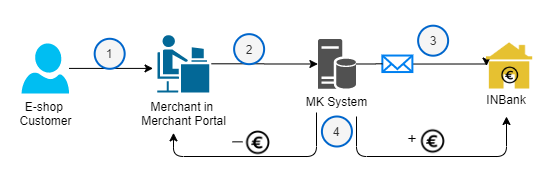

Full refund with Inbank Slice

Full refunding flow with Inbank Slice

|

Payout to customer is done by Inbank. |

Refunding with banklinks and credit card payment

Refunding flow with banklinks and credit card payments

|

|

Refunding in case of hire purchase provider

Full refunding flow with hire purchase provider Liisi, Mokilizingas and Moki3

|

Payout to customer is made by hire purchase provider. |

Create refund

$request = array(

'amount' => '4.12',

'comment' => 'broken package compensation',

'app_info' => array(

'module' => 'WooCommerce',

'module_version' => '3.2',

'platform' => 'Wordpress',

'platform_version' => '5.1'

)

);

$payment = $MK->createRefund($transaction_id, $request);

Example request body

{

"amount":"5",

"comment":"Refund reason",

"app_info":{

"module":"WooCommerce",

"module_version":"3.2.0",

"platform":"Wordpress",

"platform_version":"5.1"

}

}

HTTP REQUEST

POST /v1/transactions/{id}/refunds

Note that you should verify state of the refund in the response. You may be returned 200 response (resource created) but it's state may be FAILED. While the refund is in state SENT its amount is reserved on shop's account. You need sufficent balance on the account to make refunds. Take a look at the refund states here: Refund states

| Field | Required | Description |

| amount | Yes | Amount of the refund. |

| comment | Yes | Comment for the refund. |

app_info object

Not required but recommended: used for identification of software for debugging and statistics

| Field | Required | Description |

| module | No | Module name, that the request is sent from. (Up to 64 characters) |

| module_version | No | Module version in use. (Up to 64 characters) |

| platform | Yes |

Platform name, that the request is sent from. (Up to 64 characters) Required only if app_info is used in the request |

| platform_version | No | Platform version in use. (Up to 64 characters) |

Get refund

$payment = $MK->getRefund($refund_id);

HTTP REQUEST

GET /v1/refunds/{$refund_id}

| Field | Description |

| id | Refund ID you get from here: Create refund |

Get refund list

$payment = $MK->getRefunds($refund_id);

HTTP REQUEST

GET /v1/refunds

| Field | Description |

| since | From which date you wish to query refunds. (Example since=2019-04-10%2B0300) |

| until | Until which date you wish to query refunds. |

| status | One or more transaction status. (Example status=approved%2Ccompleted) |

| page | Which page to show. This is useful for frontend together with per_page parameter |

| per_page | How many statements in one page. This is useful for frontend together with page parameter |

Destinations

Get shipment destinations

Example request

{

"carriers": [

"OMNIVA"

],

"countries": [

"EE"

],

"types": [

"PO"

]

}

Example response body

[

{

"carrier": "OMNIVA",

"type": "PO",

"name": "Abja-Paluoja postipunkt",

"city": "Mulgi vald",

"country": "EE",

"availability": "E-R 9.00-18.00; L 9:00-14:00; P suletud",

"tempServiceHours": "10.06-10.08 avatud: E-R 9:00-17:00; L 9:00-14:00; P suletud;",

"tempServiceHoursUntil": "10.08.2019",

"provider": "OMNIVA",

"id": "69494",

"address": "Pärnu maantee 21",

"zip": "69494",

"x": "58.1261506146408",

"y": "25.353927148133"

},

{

"carrier": "OMNIVA",

"type": "PO",

"name": "Adavere postipunkt",

"city": "Põltsamaa vald",

"country": "EE",

"availability": "E-P 9:00-19:00",

"provider": "OMNIVA",

"id": "48094",

"address": "Tallinna maantee 6",

"zip": "48094",

"x": "58.7059373138417",

"y": "25.8996412135384"

}

]

HTTP REQUEST

Returns a list of possible delivery destinations based on the filter set with the fields below.

POST /v1/shipments/destinations

| Field | Required | Description |

| carries | No | List of carries, if blank shows all. OMNIVA, (SMARTPOST, DPD, OMNIVA_LV, PASTA_LV, OMNIVA_LT) |

| countries | No | List of ISO 3166 country codes |

| Types | No | APT = Automated parcel terminal, PO = Post office, PUP = Pickup point |

Shipments

Create shipments

Example request

{

"credentials":[

{

"carrier":"SMARTPOST",

"apiKey":"your_apiKey_smartpost"

},

{

"carrier":"OMNIVA",

"username":"your_uername_omniva",

"password":"your_psw_omniva"

},

{

"carrier":"DPD",

"username":"your_uername_dpd",

"password":"your_psw_dpd"

}

],

"orders":[

{

"orderId":"order 12345",

"carrier":"SMARTPOST",

"destination":{

"destinationId":"101"

},

"recipient":{

"name":"Test Robot",

"phone":"37258875115",

"email":"mk.test@maksekeskus.ee"

},

"sender":{

"name":"myTestShop.com",

"phone":"+37258875115",

"email":"support@mytestshop.com",

"country": "EE",

"county": "Harjumaa",

"city": "Tallinn",

"street": "Viru-vääna 8",

"postalCode":"69400"

}

},

{

"orderId":"order 12346",

"carrier":"OMNIVA",

"destination": {

"postalCode": "96047",

"country": "EE",

"county": "Harjumaa",

"city": "Tallinn",

"street": "Vana Lõuna 12"

},

"recipient":{

"name":"Test Robot",

"phone":"37258875115",

"email":"mk.test@maksekeskus.ee"

},

"sender":{

"name":"myTestShop.com",

"phone":"37258875115",

"email":"support@mytestshop.com",

"postalCode":"69400"

}

}

],

"app_info":{

"module":"WooCommerce",

"module_version":"3.2.0",

"platform":"Wordpress",

"platform_version":"5.1"

}

}

Example request with TMS

{

"credentials":[],

"orders":[

{

"orderId":"order 12346",

"carrier":"OMNIVA",

"destination": {

"postalCode": "96047",

"country": "EE",

"county": "Harjumaa",

"city": "Tallinn",

"street": "Vana Lõuna 12"

},

"recipient":{

"name":"Test Robot",

"phone":"37258875115",

"email":"mk.test@maksekeskus.ee"

},

"sender":{

"name":"myTestShop.com",

"phone":"37258875115",

"email":"support@mytestshop.com",

"postalCode":"69400"

}

}

],

"app_info":{

"module":"WooCommerce",

"module_version":"3.2.0",

"platform":"Wordpress",

"platform_version":"5.1"

}

}

Example response body

{

"manifests":[

"https://static.test.maksekeskus.ee/mf/201908050iAIhZTAw5y8MNkG0muTz4o1nqSI19nt.pdf"

],

"shipments":[

{

"orderId":"order 12346",

"shipmentId":"CC320669628EE"

},

{

"orderId":"order 12348",

"shipmentId":"CC320669631EE"

}

]

}

HTTP REQUEST

Generates Shipments in the carrier systems (Itella, Omniva, DPD..) Requires your own credentials at these systems provided as input or the use of TMS. Returns shipmentId(s).

POST /v1/shipments

While using MakeCommerce's Transport Mediation Service (TMS), the credentials object is not required, or it can be empty. TMS currently supports Omniva and DPD orders.

Credentials object

| Field | Required | Description |

| carrier | Yes | Potential values: OMNIVA, DPD, OMNIVA_LV, PASTA_LV, OMNIVA_LT |

| username | Yes | Your carrier username |

| password | Yes | Your carrier password |

Credentials object for Smartpost

| Field | Required | Description |

| carrier | Yes | Potential values: SMARTPOST |

| apiKey | Yes | Your Smartpost API Key |

NB! The use of the username and password fields for Smartpost are deprecated. Registering shipments or labels in Smartpost now requires the apiKey.

Orders object

| Field | Required | Description |

| orderId | Yes | Order id which to create the shipment for. |

| carrier | Yes | Potential values: OMNIVA, SMARTPOST, DPD, OMNIVA_LV, PASTA_LV, OMNIVA_LT |

| services -> serviceType | No | Potential values (Omniva only):QK: courier -> courierQP: post office -> courierPK: parcel machine -> courier* For courier serviceType is requiredPA: parcel machine -> parcel machinePU: courier -> parcel machinePV: post office -> parcel machinePO: parcel machine -> post office* default: PA

|

| destinationId | Use this with ID or | DestinationID from Get shipment destination |

| destination(postalCode, country, county, city, street) | Use this or destinationId | Destinations postal code, country(List of ISO 3166 country codes), county, city and street. |

| Recipient(name, phone, email) | Yes | Recipient name, phone number and email address |

|

Sender(name, phone, email, country, county, city, street, postalCode) OR Sender(name, phone, email, postalCode) |

Yes |

Senders name, phone number, email address, country, county, city, street name and postalcode. OR Senders name, phone number, email address and postalcode, where postalCode is a parcel machine ID (except for DPD - can be either). |

app_info object

Not required but recommended: used for identification of software for debugging and statistics

| Field | Required | Description |

| module | No | Module name, that the request is sent from. (Up to 64 characters) |

| module_version | No | Module version in use. (Up to 64 characters) |

| platform | Yes |

Platform name, that the request is sent from. (Up to 64 characters) Required only if app_info is used in the request |

| platform_version | No | Platform version in use. (Up to 64 characters) |

Get label formats

Example response body

[

"A4",

"A4_FULL_PAGE",

"A5",

"A6_FULL_PAGE"

]

HTTP REQUEST

Returns an array of all possible label print variants / formats

* LP Express currently only supports A4 - 3 per page. printFormat is ignored for create labels request

GET /v1/shipments/labels/formats

Create labels

Example request

{

"credentials":[

{

"carrier":"OMNIVA",

"username":"45041",

"password":"27T<9\\"m^F1"

}

],

"orders":[

{

"orderId":"order 12346",

"carrier":"OMNIVA",

"services":{

"serviceType":"PA"

}

"destination":{

"destinationId":"9950"

},

"recipient":{

"name":"Test Robot",

"phone":"37258875115",

"email":"mk.test@maksekeskus.ee"

},

"sender":{

"name":"myTestShop.com",

"phone":"37258875115",

"email":"support@mytestshop.com",

"city":"Riga",

"street":"brivibas iela",

"country":"LV",

"postalCode":"911"

},

"shipmentId":"CE441412466EE"

}

],

"app_info":{

"module":"WooCommerce",

"module_version":"3.2.0",

"platform":"Wordpress",

"platform_version":"5.1"

},

"printFormat":"A4"

}

Example request with TMS

{

"credentials":[],

"orders":[

{

"orderId":"order 12346",

"carrier":"OMNIVA",

"services":{

"serviceType":"PA"

}

"destination":{

"destinationId":"9950"

},

"recipient":{

"name":"Test Robot",

"phone":"37258875115",

"email":"mk.test@maksekeskus.ee"

},

"sender":{

"name":"myTestShop.com",

"phone":"37258875115",

"email":"support@mytestshop.com",

"city":"Riga",

"street":"brivibas iela",

"country":"LV",

"postalCode":"911"

},

"shipmentId":"CE441412466EE"

}

],

"app_info":{

"module":"WooCommerce",

"module_version":"3.2.0",

"platform":"Wordpress",

"platform_version":"5.1"

},

"printFormat":"A4"

}

Example response body

{

"labelUrl":"https://static.test.maksekeskus.ee/lbl/20190805tshY9Vf3Q6OO2PR1UJByFShffc6DeWhi.pdf"

}

HTTP REQUEST

Generates Parcel Labels based on Shipments created in the carrier systems (Itella, Omniva, DPD..) Requires your own credentials at these systems provided as input or the use of TMS. Returns url to generated label(s) in .pdf format.

POST /v1/shipments/createlabels

While using MakeCommerce's Transport Mediation Service (TMS), the credentials object is not required, or it can be empty. TMS currently supports Omniva and DPD orders.

Credentials object

| Field | Required | Description |

| carrier | Yes | Potential values: OMNIVA, DPD, OMNIVA_LV, PASTA_LV, OMNIVA_LT |

| username | Yes | Your carrier username |

| password | Yes | Your carrier password |

Credentials object for Smartpost

| Field | Required | Description |

| carrier | Yes | Potential values: SMARTPOST |

| apiKey | Yes | Your Smartpost API Key |

NB! The use of the username and password fields for Smartpost are deprecated. Registering shipments or labels in Smartpost now requires the apiKey.

Orders object

| Field | Required | Description |

| orderId | Yes | Order id which to create the shipment for. |

| carrier | Yes | Potential values: OMNIVA, SMARTPOST, DPD, OMNIVA_LV, PASTA_LV, OMNIVA_LT |

| Service (serviceType) | ||

| destinationId | Use this with ID or | DestinationID from Get shipment destination |

| destination(postalCode, country, county, city, street) | Use this or destinationId | Destinations postal code, country(List of ISO 3166 country codes), county, city and street. |

| Recipient(name, phone, email) | Yes | Recipient name, phone number and email address |

| Sender(name, phone, email, postalCode) | Yes | Senders name, phone number, email address and postal code. |

| shipmentId | Yes | shipmentId from Create shipments |

| printFormat | Yes | Page size |

app_info object

Not required but recommended: used for identification of software for debugging and statistics

| Field | Required | Description |

| module | No | Module name, that the request is sent from. (Up to 64 characters) |

| module_version | No | Module version in use. (Up to 64 characters) |

| platform | Yes |

Platform name, that the request is sent from. (Up to 64 characters) Required only if app_info is used in the request |

| platform_version | No | Platform version in use. (Up to 64 characters) |

Tracking Service

Examples of use

Test environment request:

https://tracking.test.makecommerce.net/CE400031817EE?carrier=omniva&dst=ee&lang=en

Redirects to:

https://minu.omniva.ee/track/CE400031817EE/?language=en

Live environment request:

https://tracking.makecommerce.net/CE400031817EE?carrier=omniva&dst=ee&lang=et

Redirects to:

https://minu.omniva.ee/track/CE400031817EE/?language=et

REDIRECTION

MakeCommerce's tracking service provides a service that allows a simple redirection for locating different carriers' packages.

This removes the need for keeping any tracking links locally, provides an easy implementation for tracking shipments and allows for realtime updates.

https://tracking.makecommerce.net/{shipmentId}?carrier=&dst=&lang=

| Parameter | Required | Description |

| shipmentId | Yes | Shipment ID that is used to track the package |

| carrier | Yes | Potential values: omniva, smartpost, dpd, lpexpress |

| dst | No | Destination country of the shipment in order to display that country's page. Values: ee, lv, lt, fi |

| lang | No | Which language to display. Values: en, et, lv, lt, ru. Without translations: fi, sv |

The service will use default dst and lang values when they are not provided.